" Shift4's volume growth has accelerated (+53% YoY in 3Q22, +54% in 4Q22, + 66% in 1Q23) suggesting that Shift4's ambitious expansion initiatives are gaining traction." BTIG initiates PayPal and SoFi as buy BTIG initiated several fintech and payment companies Wednesday and said it's a "pivotal point for Fintech stocks" such as PayPal and SoFi.

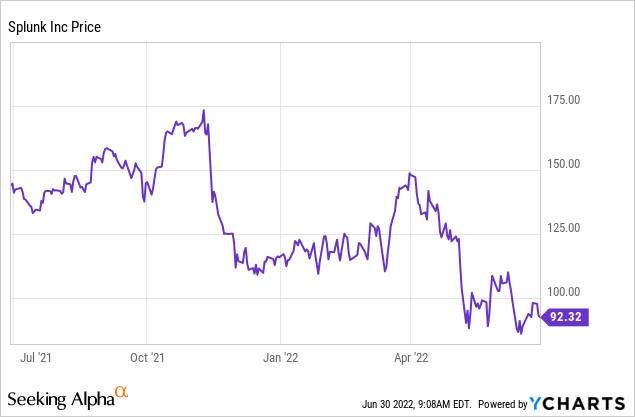

#SPLUNK STOCK UPGRADE#

international, category diversification)." SVB Securities upgrades Shift4 Payments to outperform from market perform SVB Securities said in its upgrade of the payment company that it sees increasing volume growth. " DECK has a long track record of strong execution 2) HOKA brand has strong momentum and is in the early innings of long-term growth globally 3) UGG remains an attractive brand and has LT opportunities (incl. "With only ~10% or less upside over the next 12 months, we do not believe there is enough reward to justify buying these stocks given the risks." Raymond James initiates Deckers as outperform Raymond James said in its initiation of the shoe company that it likes its wide array of products and is bullish on management execution. "After the close on June 13th, Logitech announced its president and CEO, Bracken Darrell, is immediately departing for an outside opportunity, but remaining present for a one-month transition to interim CEO Guy Gecht." Needham downgrades Applied Materials and KLA to hold from buy Needham downgraded several semiconductor stocks such as Applied Materials and KLA and said it sees a less attractive risk/reward. As a result, the company's extensible platform drives a high rate of innovation in solving new use cases for customers, which is evident in the projected CY25 TAM of $220 Billion." Citi downgrades Logitech to neutral from buy Citi downgraded the stock due to the unexpected departure of CEO Bracken Darrell.

#SPLUNK STOCK CODE#

" ServiceNow is built on a single code base, a single data model, and a single database. "We're downgrading DASH shares to Hold from Buy as we now see a balanced risk/reward profile with top- and bottom-line upside (across both print vs consensus and guidance vs consensus) no longer enough to drive favorable share price reaction." Needham initiates ServiceNow as buy Needham said ServiceNow is an artificial intelligence beneficiary.

#SPLUNK STOCK FULL#

"While we see the stock as fairly valued at currently levels, we see a path (and precedent) for AAPL continuing to grind higher near-term, given its historically strong seasonal trading period in advance of new iPhone launches is in full swing, and we see limited risk to estimates through the end of this fiscal year." Gordon Haskett downgrades DoorDash to hold from buy Gordon Haskett said it sees more balanced risk/reward outlook for DoorDash. The low multiple on the stock captures a pretty wide range of what should still be earnings growth in a bad market, limiting the downside risk." Bernstein reiterates Apple as market perform Bernstein said the stock is fairly valued and that buybacks could be helping shares.

"We are expecting an in line quarter, and while making a conviction call on the guide is difficult, we don't think the bar is that high here. Bernstein reiterates FedEx as outperform Bernstein said the bar is "not that high" heading into FedEx earnings next week. Our Ad Metrics data suggests pricing is weaker, but spend is holding up." Read more about this call here.

"We see a once in a life-time opportunity for Netflix to benefit from both ARPU & subscriber gains (newly monetized subs & premium/standard accounts that split into multiple accounts), at nearly 100% incremental margins." Piper Sandler reiterates Meta as outperform Piper Sandler raised its price target on the stock to $310 per share from $270 and said ad spend is "holding up." "We are now more confident in META's re-acceleration and raise 2H23 revenue & out-year estimates.

#SPLUNK STOCK PASSWORD#

"While we believe Netflix continues to be structurally the best positioned to benefit from engagement shift toward streaming, present valuation seems to more than adequately reflect potential upside from near-term growth optimization tools like paid sharing and advertising." Wolfe reiterates Netflix as outperform Wolfe raised its price target on the stock to $485 per share from $388 and said it's bullish on the company's password sharing crackdown opportunity. "This is an idea that we really 'like' on a relative basis to our other coverage and we are favorable on the Risk-Reward setup." Barclays reiterates Netflix as equal weight Barclays raised its price target on the stock to $375 per share from $250. Piper Sandler initiates Domino's as overweight Piper said it sees an attractive risk/reward for Domino's shares.

Here are Wednesday's biggest calls on Wall Street.

Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)